german tax calculator for students

In this section you can find detailed information about tax and finances in Germany with supporting online calculators. Easy-to-use salary tax calculator for computing your net income in Germany after all taxes have been deducted from your gross income.

Excel Formula Income Tax Bracket Calculation Exceljet

This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022.

. With an income of between 450 and 850 Euro per month or more than 20 working hours per week the amount is reduced. Tax Rates Lohnsteuer A basic personal allowance is deducted from taxable income it is for single persons. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a.

On this page we provide an introduction to the tax system in Germany including Personal Income Tax PIT and Corporation Income Tax CIT and a German Income Tax Calculator which can be used to. The minimum taxable income is 9169 no tax is charged under this amount. Germany has a progressive taxation system.

Income Tax Solidarity Surcharge Pension Insurance Unemployment Insurance Health Insurance Care Insurance. The tax rate starts at 14 rising in a series of income tax brackets to 45 for the highest earners over 265327. Gross Net Calculator 2021 of the German Wage Tax System.

So if they want to take taxed money back then it is a must for them to file a student tax return in Germany. An income up to 450 Euro is exempted from contribution. Use our income tax calculator to calculate the tax burden resulting from your taxable income.

The financial year in Germany begins on the 1 st of January and ends on the 31 st of December. The last date for filing for taxes in Germany for the tax year of 2018 is on the 31 st of May. Easily calculate various taxes payable in Germany.

In order to be able to better plan the costs of your vehicle it makes sense to calculate the car tax in advance. Working student wage calculator Germany. To get an idea of how much income tax you will have to pay you can use this income tax calculator in German.

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Annual tax return Steuererklärung. Tax Filing In Germany For International Students Quick Facts.

It is always interesting to know how much tax you have to pay once you work part-time in GermanySurely when you work you must pay taxes regardless your status. Car tax calculator for Germany. The Federal Central Tax Office Bundeszentralamt für Steuern BZSt offers an income tax calculator which estimates the percentage of income tax you have to pay.

Students who earn 450 euros or less not pay any tax because 450 euros income is a tax-free income in Germany. In the following you can find out which data you need to have at hand in order to use the. You are required to file a tax return.

What is the tax rate in Germany 2019. Our car tax calculator supports you in this and calculates immediately how much tax is due for your car. In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis.

As you may imagine not every citizen is in the same tax bracket. If you receive a salary only as an employee on a German payroll you get. Above this income there are flat rates.

You have to enter both spouses gross salaries and tick the box whether you have children. German Income Tax Calculator Expat Tax. For a quick estimation of whether you should consider a tax class change to 3 and 5 you can use this German tax class calculator.

Hundreds of thousands of satisfied customers. Filing your tax return is worth it. Posted on April 29 2018 October 30 2018 by Umer.

This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property. If your income falls within the second tax bracket and you earn a gross salary of 25000 you are likely to be taxed at a rate of 29 per cent. Voluntary tax return Student Steuererklärung.

As a working student you enjoy a special status that exempts you from some taxes. The German Tax Department doesnt return this money voluntarily to these students. Our salary calculator offers you the possibility to calculate your working student salary quickly and easily.

But it is also not as bad as a lot of people think. In 2021 an income of less than 9744 year is tax-free. Your respective tax office will assign you a tax bracket.

The SteuerGo Gross Net Calculator lets you determine your net income. Millions of euros in tax refunds for. Online Calculators for German Taxes.

2022 2021 and earlier. To start with this rate increases progressively up to a rate of 42 for a taxable income of 27782500. If youre struggling to visualise how all of this affects your income a German tax calculator can give you a good idea of how much money youll actually take home each month.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. Try it for free. You can expect a high tax refund.

In 2021 above 274612 year the 2007 new created income tax riche tax is 45 tax above 274612. You will most likely get a very high tax refund. It really depends on your income that how much taxes you have to pay.

Just do your tax return with SteuerGo. For example an employer can calculate an employees income tax Lohnsteuer by means of the tax brackets. As you can see in the picture above your net-income becomes 216210 Euro per month which is 26852 Euro per month more than a person in tax-class I.

High nominal tax rates dont hurt as much if the amount of taxable income is low. PhD student with contract TV-L E13 50 wp_ad_camp_5 In this example we consider a single PhD student Lohsteuerklasse I with TV-L E13 50. It is in German but pretty self-explanatory.

German Grossnet Calculator Wage Calculator for Germany. You can enter the gross wage as an annual or monthly figure. You can see at a glance what your gross and net income is.

Welcome to the German tax section of iCalculator. TAX BRACKETS Steuerklassen There are 6 tax brackets Steuerklassen in Germany. Germany is certainly not a low-tax jurisdiction.

File your tax returns at the local tax office based on your place of residence in Germany. Whoever earns more pays higher contributions. Program to calculate the Wage Tax for 2010-2016 JavaScript programm calculates online the German wage tax for 2010-2016 considering age children.

Incomes up to 57918 are taxed with a rate progressively increasing from 14 to 42. The minimum tax rate is 14. As of an income of 850 Euro per month students pay the full share of 945.

You can find a FREE online tax calculator in English language the most frequently asked tax questions by expats living and working in Germany here expattaxde. German Tax Class Calculator. 32a EStG describes how the income tax was calculated in 2009.

You want to quickly calculate the probable amount of your income tax when working in Germany. Student Tax System in Germany.

Germany Taxing Wages 2021 Oecd Ilibrary

German Tax Calculator Easily Work Out Your Net Salary Youtube

What Are Marriage Penalties And Bonuses Tax Policy Center

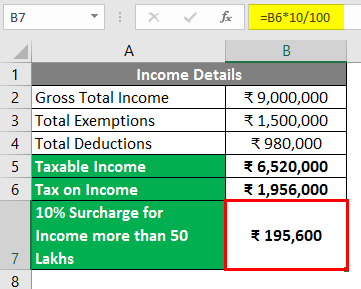

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Us Income Tax Calculator March 2022 Incomeaftertax Com

Are College Scholarships And Grants Taxable Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Foreigner S Income Tax In China China Admissions

Best Tax Software Of 2022 Forbes Advisor

German Vat Calculator Vatcalculator Eu

German Tax Calculator Easily Work Out Your Net Salary Youtube

German Income Tax Calculator Expat Tax

German Income Tax Calculator Expat Tax

Residential Status Calculator Should An Nri File Taxes In India

Income Tax In Germany For Expat Employees Expatica

How To Calculate Foreigner S Income Tax In China China Admissions